2026年美国与全球经济展望:不受欢迎的特朗普

All Eyes on the U.S. in 2026

America and the global economy in 2026

2026年美国与全球经济展望

Yesterday we looked at what this year might bring for different parts of the world. Today we’re looking at the country that will affect most parts of the world: the United States. Will President Trump forge peace in Ukraine (and win the Nobel Peace Prize)? Will he invade Greenland? We also look at the potential for an A.I. bust, a debt crisis and a blow to Trump’s tariff policies. Here’s what my colleagues think 2026 might have in store for the U.S. and the global economy.

昨天我们展望了全球不同地区的年度前景,今天将聚焦对全球多数地区影响深远的国家——美国。特朗普总统能否促成乌克兰和平(并斩获诺贝尔和平奖)?他会入侵格陵兰岛吗?我们还将探讨人工智能泡沫破裂、债务危机以及特朗普关税政策受挫的可能性。以下是本报同事对2026年美国及全球经济走向的分析。

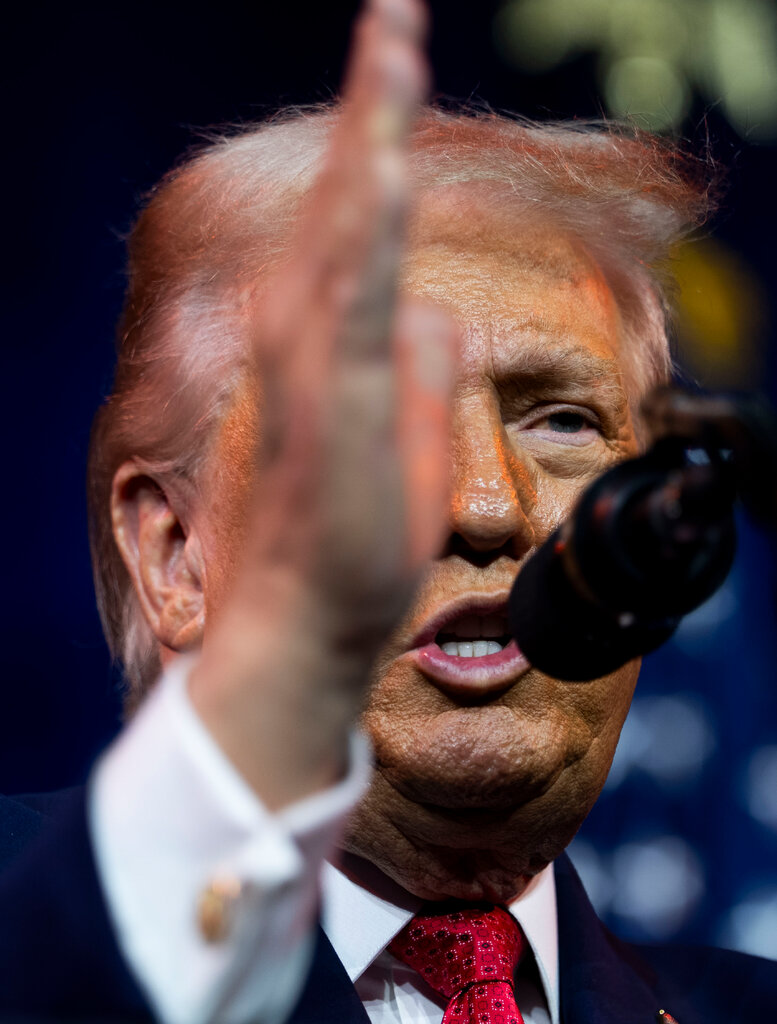

‘Trump is not popular’

“特朗普不受欢迎”

David E. Sanger and Anton Troianovski, Washington correspondents

华盛顿记者戴维·桑格和安东·特罗亚诺夫斯基

广告

Trump makes no secret of his desire for a Nobel Peace Prize. He oversaw military strikes in a half-dozen countries in 2025, but he also spent much of the year trying to build his credentials as a peacemaker: a fragile cease-fire in Gaza, a diplomatic sprint for peace in Ukraine that has yet to pan out.

特朗普毫不掩饰自己对诺贝尔和平奖的渴望。2025年,他主导了对六个国家的军事打击,但同时也花了大量时间塑造“和平缔造者”形象:促成加沙达成脆弱停火协议,为推动乌克兰和平开展密集外交斡旋,尽管后者尚未取得成效。

Then, on Saturday, he attacked Venezuela, the most stunning military intervention of his term.

然而上周六,他下令袭击委内瑞拉,这成为其任期内最令人震惊的军事干预行动。

Since then, he has threatened Colombia and Cuba, and warned Iran’s leaders that they could “get hit very hard.” The idea that the U.S. might acquire Greenland once seemed like a joke; after Venezuela, it would be foolish not to take him seriously.

此后,他先后威胁哥伦比亚和古巴,并警告伊朗领导人,他们“可能会遭受沉重打击”。美国收购格陵兰岛的构想一度被视为笑谈;但在委内瑞拉事件后,若再对他的言论掉以轻心,未免太过愚蠢。

But the U.S. president does face some constraints, including domestic politics. The midterm elections that determine control of the House and Senate will take place in November, and Trump is not popular: He has an approval rating of 42 percent. A recent poll found that just a third of U.S. voters approved of the strike on Venezuela.

不过这位美国总统确实面临一些制约,其中包括国内政治因素。决定参众两院控制权的中期选举将于11月举行,而特朗普的支持率仅为42%,并不受欢迎。近期民调显示,仅三分之一的美国选民支持对委内瑞拉的打击行动。

Unpopular though the strike may have been, U.S. elections rarely turn on foreign policy. They turn on the economy, and that doesn’t bode well for Trump, either. Inflation has been pushing just over 3 percent (though the most recent numbers were lower), unemployment hit a four-year high, and Trump is already backing away from tariffs on beef and other products.

尽管此次军事打击不得人心,但美国选举很少由外交政策主导,经济才是关键,而这对特朗普而言同样不容乐观。通胀率一直略高于3%(尽管最新数据有所下降),失业率创下四年新高,特朗普已开始放弃对牛肉及其他产品加征关税的计划。

During the election itself, look for efforts to ban mail-in voting, which Trump claims, without evidence, leads to fraud. He could assert more federal control over the vote counting. Trump is expert at declaring elections “rigged.” If he loses, he presses the case; if he wins, he drops the subject.

选举期间,预计特朗普阵营将试图禁止邮寄投票(他毫无证据地声称这种投票方式会导致舞弊),还可能主张联邦政府加强对计票过程的控制。特朗普擅长宣称选举“被操纵”:若选举失利,他会大肆宣扬这一说法;若胜选,则会对此绝口不提。

广告

The wild card

潜在变数

The A.I. boom that has been supporting the U.S. economy could turn out to be a bubble and end a remarkable run in the markets. If a 2009-style market meltdown follows, that could accelerate the sense among voters that the economy has been mismanaged.

一直支撑美国经济的人工智能热潮可能演变为泡沫,进而终结市场的非凡涨势。若随之而来的是2009年式的市场崩盘,可能会加剧选民对经济管理不善的认知。

The push for peace in Ukraine seems to be on shaky ground. But if a renewed effort actually stopped the fighting, who knows? Maybe he really could win the Nobel Peace Prize.

乌克兰和平进程看似岌岌可危,但如果新一轮斡旋真能终止战事,谁又能说准呢?或许他真的能赢得诺贝尔和平奖。

‘Uncertainty remains the watchword’

“不确定性仍是关键词”

Patricia Cohen, global economics correspondent

全球经济记者帕特里夏·科恩

Despite the havoc wrought by Trump’s helter-skelter tariff policies, the global economy last year proved to be more resilient than many feared. But uncertainty remains the watchword.

尽管特朗普混乱无序的关税政策造成了严重破坏,但去年全球经济的韧性超出了许多人的预期。不过,不确定性仍是当前全球经济的核心关键词。

广告

The surprise toppling of Venezuela’s leader and Trump’s claiming of the country’s oil reserves might be a prelude to even more American foreign interventions, which could reverberate through oil, crypto and stock markets. That’s on top of continuing conflicts and political tensions in Ukraine, the Middle East, Asia and elsewhere.

委内瑞拉领导人意外下台以及特朗普宣称掌控该国石油储备,可能预示着美国将采取更多海外干预行动,这将在石油、加密货币和股票市场引发连锁反应。此外,乌克兰、中东、亚洲等地的冲突和政治紧张局势仍在持续。

And then there’s the looming possibility that the U.S. Supreme Court rules Trump’s tariffs, which have hit roughly 90 countries, to be largely unconstitutional. China, for its part, is likely to continue to flood the world with cheap exports to sustain its own growth. Outside of the U.S., that could help keep inflation in check. But it will also put pressure on businesses in Europe, Southeast Asia and Latin America as they struggle to compete.

更值得关注的是,美国最高法院可能裁定特朗普针对约90个国家的关税政策在很大程度上违宪。而中国方面,可能会继续向全球大量输出廉价商品以维持自身增长。对美国以外的国家而言,这或许有助于抑制通胀,但也将给欧洲、东南亚和拉丁美洲的企业带来竞争压力,使其陷入艰难的生存困境。

In the rivalry between China and the U.S., both powers will be pushing to make advances in artificial intelligence and robotics — priorities that will drive overall economic growth and soak up investment, and also significantly drive up the demand for energy and other key resources like water and critical minerals.

在中美竞争中,两国都将争相在人工智能和机器人技术领域取得突破——这些优先事项将推动整体经济增长、吸引大量投资,同时也会显著推高对能源、水资源和关键矿产等核心资源的需求。

The wild card

潜在变数

Record debt in many wealthy economies, including the U.S., hasn’t gotten much attention but it puts a lot of stress on the global financial system.

包括美国在内的许多富裕经济体的创纪录债务并未受到太多关注,但给全球金融体系带来了巨大压力。

U.S. Treasury bonds have long been the world’s safe haven, and the Federal Reserve has been relied on to provide the world with dollars in case of a short-term cash crunch. But central bankers and political leaders have started asking themselves whether the Fed, under pressure from Trump, can be counted on. Such high sovereign debt means “the system is fragile,” Richard Portes, an economist who serves on the European Systemic Risk Board, told me. We may find out this year if the world economy is operating without its usual safety net.

长期以来,美国国债一直是全球金融避风港,美联储也被视为在短期资金短缺时向全球提供美元流动性的可靠保障。但各国央行官员和政治领导人已开始质疑:在特朗普的压力下,美联储是否仍值得信赖?欧洲系统性风险委员会经济学家理查德·波特斯向我指出,如此高的主权债务意味着“整个体系极为脆弱”。今年,我们或许将见证全球经济在没有惯常的安全网的情况下能否正常运转。